How to Calculate Pe Ratio

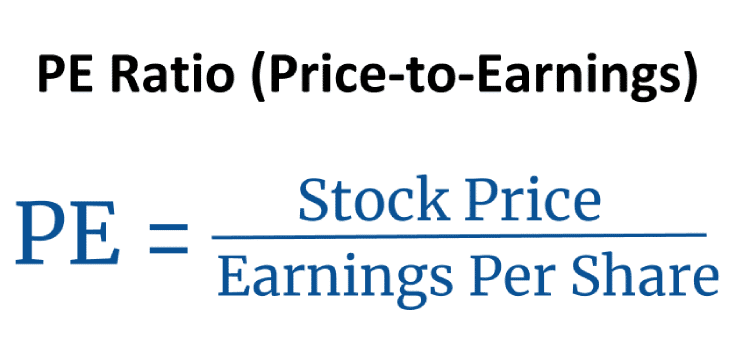

The price-earnings ratio PE ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings. The formula to calculate the PE ratio is as follows.

Pe Ratio Price To Earnings Definition Formula And More Stock Analysis

Price to earnings ratio based on trailing twelve month as reported earnings.

. Next determine the interest rate which was agreed upon at the outset and should be presented in a decimal number for calculation. But April 2021 onwards consolidated earnings are used. A PEG ratio of 10 or lower on average indicates that a stock is undervalued.

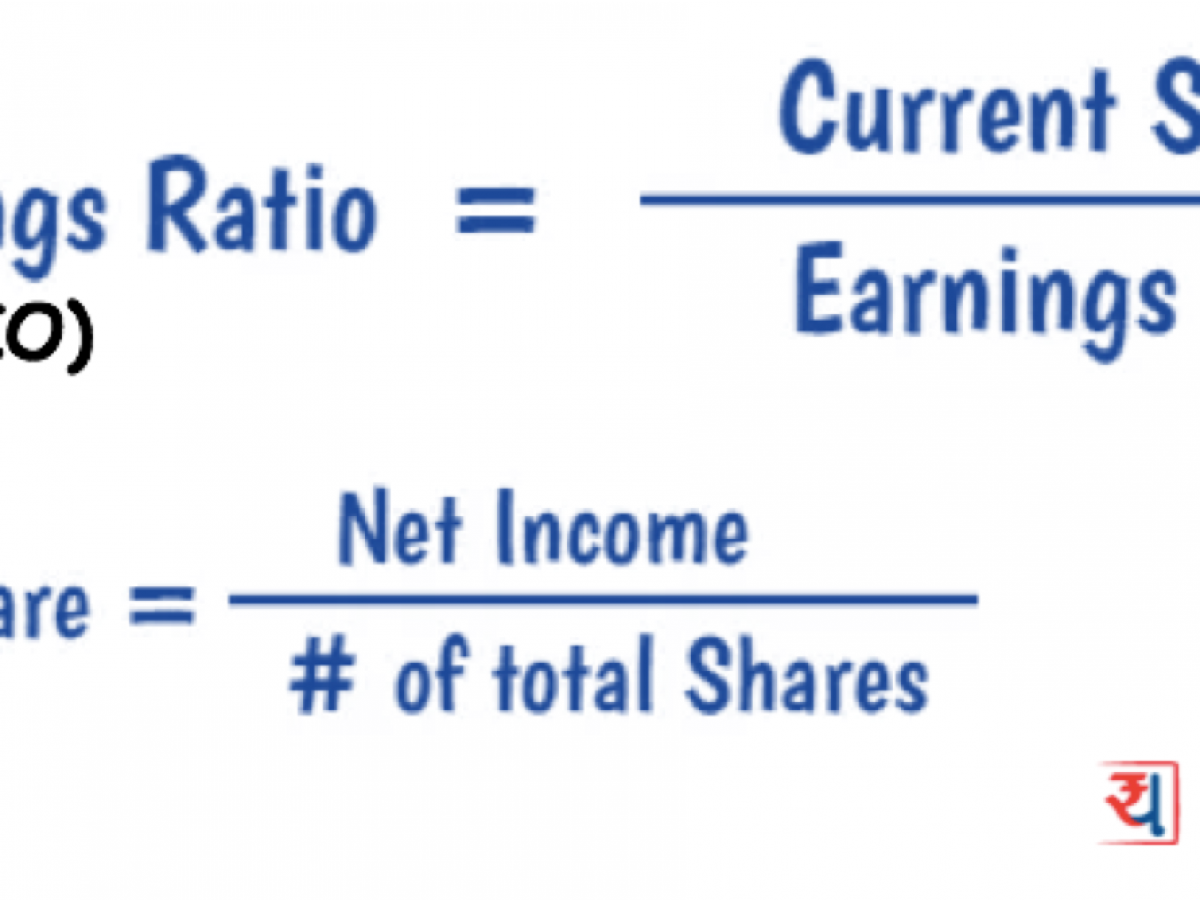

PE Ratio Market Value per ShareEarnings per Share EPS. How Does the PE Ratio Price to Earnings Ratio Work. PE is short for the ratio of a companys share price to its per-share earnings.

To learn more about calculating percentages watch the video or try the quiz. If the height of a duct is 12 300mm then its width should not exceed 48 1200mm. Stock price refers to the current market price of a stock or share.

Before we get into the specifics of how to calculate stock price though lets be clear on what the stock price is. PE Ratio Market Value per ShareEarnings per Share EPS. A PEG ratio of 10 or lower on average indicates that a stock is undervalued.

This is great news as it shows a complete picture. If we would find out that the historical average of PE ratios for company A is 10 suddenly the current PE ratio of 20 wouldnt look so attractive anymore. PE is short for the ratio of a companys share price to its per-share earnings.

Data courtesy of Robert. Its easy to calculate as long as you know a given companys stock price and earnings per share EPS. 1 Dont Exceed 14 Duct Ratio.

- Current market share price which can be obtained from stock exchange sites Yahoo Finance Google Finance or any financial centre stock exchange website. Ducts with a duct ratio of more than 14 are not efficient due to high friction loss. How to calculate the price earnings ratio.

The price-earnings ratio PE Ratio is the relation between a companys share price and earnings per share. A PEG ratio greater than 10 indicates that a stock is overvalued. Growth ratios are indicators of how fast our business is growing.

Then determine the length of time or term the interest will be accruing which is. Trailing Price-To-Earnings - Trailing PE. Generally you want to keep the duct ratio not more than 1 to 4.

Read more EVEBIT EVCustomer etc. Before you can use it you have to learn what the PE ratio is. The forward PE ratio differs from the standard PE ratio in that it is not based on historical earnings.

A higher PE ratio means that investors are paying more for each unit of net income making it more expensive to purchase than a stock with a lower PE ratio. To work out the percentage of something it helps to find out what one percent is first. JavaScript is required to.

To calculate the PE you simply take the current stock price of a company and divide by its earnings per share EPS. Price-Earnings Ratio - PE Ratio. Duct ratio is the ratio between the width and the height of the duct.

The PE ratio and other Multiples dividends and. Lets get into it. What is PEG Ratio Formula.

As a result one approach to using the PE ratio would be to calculate the historical average of PE ratios for the company and compare that average with the current value. Robert Shiller and his book Irrational Exuberance for historic SP 500 PE Ratio. PE ratio is a metric that compares a companys current stock price to its earnings per share or EPS which can be calculated based on historical data for trailing PE or forward-looking.

SP 500 10-year average EPS. A PEG ratio greater than 10 indicates that a stock is overvalued. Lets use data from his site to calculate the Shiller PE ratio for the SP 500 as of June 2021.

What is Stock Price. 10365 Inflation-adjusted EPS. Trailing price-to-earnings PE is calculated by taking the current stock price and dividing it by the trailing earnings per share EPS for the past 12.

The price-to-earnings ratio or PE ratio was made famous by Benjamin Graham who encouraged investors to use it to avoid overpaying for stocks. Either you do it by hand or by using this PE ratio calculator as explained above basically there are required two values that should be given. A stocks PE ratio is calculated by taking its share price and divided by its annual earnings per share.

Price earnings ratio is based on average inflation-adjusted earnings from the previous 10 years known as the Cyclically Adjusted PE Ratio CAPE Ratio Shiller PE Ratio or PE 10 FAQ. To value such companies. Current PE is estimated from latest reported earnings and current market price.

Standalone earning includes income earned by only the parent company. The price-to-earnings ratio or PE ratio provides the ratio of earnings per share against the current market price per share. The forward price-to-earnings PE ratio is a projected PE ratioThe standard PE ratio is calculated by dividing the stock price per share by the earnings from the previous year.

How to Calculate Stock Price. Information Services PE. A listed company generally has a PE ratio unless its unprofitable.

To calculate the PE you simply take the current stock price of a company and divide by its earnings per share EPS. To calculate interest start by determining the principal which is the amount of money youll be calculating interest on. PE Ratio Market Value Per Share Earning Per Share.

Shiller PE ratio for the SP 500. Earlier standalone earnings were used to calculate Niftys PE ratio. Whereas consolidated earnings include income earned by both parent and its subsidiaries.

The PE Ratio helps investors gauge the market value of a share compared to the companys earnings. Read more or PriceEarnings to Growth ratio refers to the stock valuation method based on the. These growth ratios include sales.

Investors and analysts can use these numbers to calculate a forward PE ratio. Instead analysts use multiples like PE PEG PEG The PEG ratio compares the PE ratio of a company to its expected rate of growth. The term PEG ratio PEG Ratio The PEG ratio compares the PE ratio of a company to its expected rate of growth.

It denotes what the market is willing to pay for a companys profits.

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube

Price Earnings Ratio Formula Examples And Guide To P E Ratio

P E Ratio Price To Earnings Formula And Calculator Excel Template

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

Price Earnings Ratio Formula Examples And Guide To P E Ratio

0 Response to "How to Calculate Pe Ratio"

Post a Comment